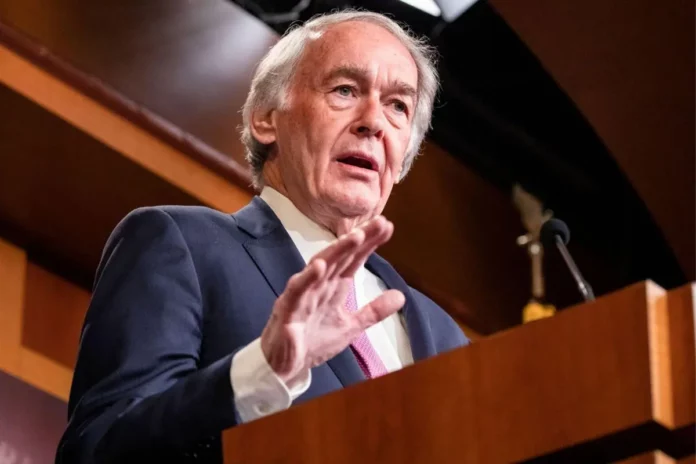

In an effort to address environmental concerns and foster equity in taxation, Senator Ed Markey unveiled a proposed legislation aimed at raising taxes on private jet fuel. The bill, titled the Fueling Alternative Transportation with a Carbon Aviation Tax (FATCAT) Act, seeks to elevate federal taxes on private jet fuel from $0.22 to $1.95 per gallon.

Private jet travel, known for its high carbon footprint, has experienced a surge in recent years. Despite this, private jet travelers contribute significantly less to the taxes that support US airports and aviation safety, compared to commercial flyers. A report by the Institute for

Policy Studies and Patriotic Millionaires found that private travelers pay just two percent of the taxes funding the Federal Aviation Administration (FAA) despite accounting for approximately one in every six flights managed by air-traffic controllers.

Also read: Florida Governor DeSantis Signs Bill Reforming Alimony Laws, Ending Permanent Alimony

Senator Markey, a member of the Senate Commerce, Science, and Transportation Committee, emphasized the need for equity in taxation, stating, “The 1 percent can’t free ride on our environment and our infrastructure at a discount.”

The proposed tax increase aims to support a Clean Communities Trust Fund, overseen by the Treasury, which would finance air quality monitoring initiatives and bolster affordable public transportation, including passenger rail and bus systems near commercial airports.

It is clear that the proposed legislation seeks to hold the wealthiest individuals accountable for their carbon dioxide emissions. The spokesperson for Senator Markey pointed out that the wealthiest one percent of the global population was responsible for over double the carbon dioxide emissions of the poorest 50% between 1990 and 2015.

With this bill in motion, the conversation on private jet taxation and its impact on the environment and society is gaining momentum, as lawmakers strive for a more sustainable and equitable future.